COMMUTER PROTECTION PLAN

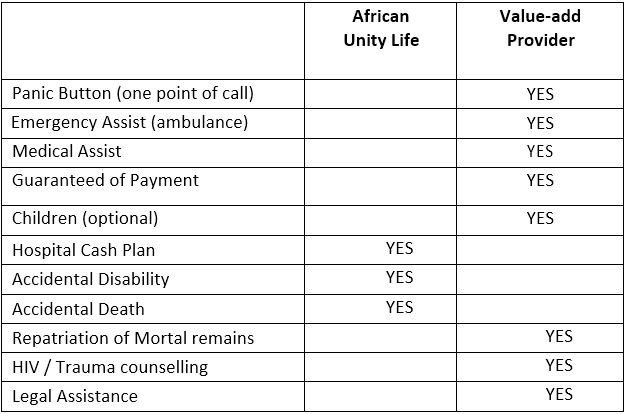

The EvoluSure Commuter Protection Plan consists of insured benefits and value-added benefits.

READ MORE

PRODUCT DESCRIPTION

It is an individual life policy that provides multiple insured and value-add benefits. It offers one point of contact with an emergency panic button/contact number for all accident related issues (as well as certain extended benefits), as identified below:BENEFITS

• EVOLUSURE USSD/CONTACT NUMBER/APP (One point of call)

EvoluSure has a direct contact number, as well as its own unique USSD, which acts as a “panic” button in the event of an emergency. A 24/7/365 call centre will contact the member within 30 seconds in order to establish the need.• EMERGENCY ASSIST

Based on the telephonic assessment, the call for help would be classified as a life-threatening medical emergency or not. In the event of a medical emergency, the nearest, most appropriate ambulance service would be dispatched. The patient would be taken to the nearest, appropriate medical facility to be

stabilized.

Should the situation not require an emergency response, the caller would receive guidance on how to deal with the situation by offering medical/health advice and/or referral to a medical practitioner.Extended benefit:

Emergency Medical Advice and Assistance

Telephonic guidance and advice with a medical crisis incident

General health & lifestyle advice

Telephonic information on minor illnesses and health topics such as supplements, acne, obesity, healthy eating plans, eating disorders, exercise routines, medical conditions, chronic illnesses, living with HIV/Aids and surgical procedures, etc.• GUARANTEED ADMISSION

A hospital admission guarantee of R20 000 is provided to the private medical facility in order to ensure admission and for the patient to be stabilised before being moved to a public facility if they do not have private medical insurance cover.

In-Hospital Medical

Monitoring

In the event of emergency medical treatment and hospitalisation outside the client’s town of permanent residence, the helpline monitors the patient’s condition and takes care of messaging to relatives or next of kin on a regular basis until the patient is discharged from the medical facility.

Compassionate Visits

Arrangements in terms of compassionate visits are made and cost paid for in the event of emergency medical treatment and hospitalisation which takes place outside the client’s town of permanent residence, exceeding five (5) consecutive days.

Escorted Return of Minors

Arrangements in terms of escorted return transport are made and cost paid for in the event of emergency medical treatment and hospitalisation which results in minor children being left stranded.• HOSPITAL CASH PLAN

Daily cash of R500.00 is paid to the member while in hospital, and is normally utilised to pay for personal incidentals, snacks, family taxi fare, etc.• ACCIDENTAL DISABLITY

Accidental disability cover of up to R15,000.00 is payable, dependant on the severity of the injury.• ACCIDENTAL DEATH

In the event of the death of the member, as a result of an accident, an amount of R15,000.00 is payable in lieu of funeral benefits.• REPATRIATION OF MORTAL REMAINS

In the event that the body of the deceased is required to be transported to the home town, the following benefits have been included:

o Location of deceased

o Overnight accommodation (1xperson) to identify the body (R5000)

o Repatriation to funeral home closest to place of burial in RSA only

o 1x Family member can accompany the body

o Assistance with all paperwork / funeral arrangements

o Advice on how to apply for the death certificate

o Referral to a reputable funeral

o Referral to a Pathologist if an autopsy is required• HIV / TRAUMA ASSIST

This benefit provides members with the following:

• 24-hour emergency assistance helpline / protection service

• 3 HIV related trauma consultations

• 3 Blood tests and access to STD preventative medication

• Access to the “morning-after-pill”

• Trauma – covers R5000 per insured – max of R10 000 per family• LEGAL ASSISTANCE

Legal Assistance is made available to the member (telephonic/face-to-face consultation), should the member wish to institute legal action, due incidents/issues related to the accident.Extended benefit:

Access to 24-hour legal advice helpline – any law

30 Minute consultation – any law

Free standard legal documents e.g. employments contracts etc.Evolusure Brokers – Just call our friendly staff on 081 350 2530 during work hours Monday to Friday for any assistance with services or membership.

HAVE ANY QUESTIONS SO FAR?

CREDIT LIFE

It is an individual life policy that provides death, permanent disability, temporary disability, critical illness and retrenchment benefits for the principal life assured. It is designed to cover the outstanding balance of a loan agreement at the date that the insured event occurred or diagnoses was made.

READ MORE

Ranges from R2,20 – R4,50 / R1000.00

- Death / Critical Illness

If you should die or be diagnosed with a critical illness as per definition, we will pay the outstanding balance of your agreement at the date the insured event occurred or diagnoses was made, less any monthly instalments in arrears or interest thereon.

- Permanent total disability: shall mean such incapacity which renders you incapable from following your own or similar occupation, defined as the regular and/ or normal occupation in which you are engaged for remuneration or profit but expanded also to include any occupation for which you are reasonably qualified to be engaged in by your qualifications, status, training, working and/ or occupational experience for more than 50% of your normal remuneration or profit. The term permanent total disability shall include where you have suffered the loss of both hands or both feet, or one hand and one foot, or the sight of both eyes.

- Temporary Disability: means being temporarily unable to work because of an injury or illness.

- Critical illness: One or more of the following conditions: heart attack, coma, replacement of heart valve, surgery for a disease of the aorta, cancer, stroke, major organ transplant, coronary artery disease requiring bypass surgery and kidney failure. Critical illness must be certified by a duly qualified and registered medical doctor with the appropriate specialist knowledge.

- Retrenchment / redundancy: means the termination of your service by your employer, but does not include retirement, voluntary retrenchment or dismissal

FUNERAL COVER

Various Funeral Plans provide cover in the event of the death of the insured member. The Plans are designed for those who wish to ensure that his / her family has one less difficulty to deal with should an insured life pass away. Cover is provided to single members, immediate family, parents and in-law parents, as well as extended family members (brothers, aunts, etc.). The policy pays out a cash sum and value-add benefits (if selected) are provided such as repatriation of mortal remains, counselling, etc.

READ MORE

The Single Funeral Plan provides cover in the event of the death of the insured member. The policy pays out a cash sum.

Who will benefit from the Single Funeral Plan?

A single individual over 18 who wishes to ensure that his / her family has one less difficulty to deal with should the customer pass away. This would also be whereby the customer’s parents and close family can be insured to lessen the difficulty of dealing with any of them passing away.

Product Features:

- NO medicals.

- Individual cover of up to R 30,000.00

- Entry age from 18 up to 65.

- Cover:

- Main member cover option: R 10 000, R 15 000, R 20,000 and R 30 000

- Parents (2) cover option: R 5 000 and R 10 000

- Extended (2 direct family members) cover option: R 5 000 and R 10 000

- Funeral benefit paid out within 48 hours of receiving all documentation.

Value-add benefits

- REPATRIATION OF MORTAL REMAINS

In the event that the body of the deceased is required to be transported to the home town, the following benefits have been included:

- Location of deceased

- Overnight accommodation (1xperson) to identify the body (R5000)

- Repatriation to funeral home closest to place of burial in RSA only

- 1x Family member can accompany the body

- Assistance with all paperwork / funeral arrangements

- Advice on how to apply for the death certificate

- Referral to a reputable funeral

- Referral to a Pathologist if an autopsy is required

- “PERSONAL PROTECTION PLAN”:

- HIV personal protection programme

- Members will have access to the following, should they fear accidental exposure to HIV/AIDS and must contact the Care Call Centre within 24 hours of the exposure:

- Unlimited 24 hour access to the Care Call

- Telephonic counselling

- Access to an HIV medical

- An initial Starter Pack of 3 days ART’s;

- ART treatment for a further 28 ▪ Clinical disease management guidance ▪ Trauma assistance programme:

- The morning after pill;

- Sexually transmitted disease preventative medication;

- Unlimited Face-to-Face counselling

- Security benefits up to a maximum of R1500.00

- Alternative Therapies up to a maximum of R1500.00

- Members will also have unlimited access to the Care Call Centre

- Trauma Assistance

- In the event that the member is exposed to: Rape; Hijacking; Assault; Mugging; Armed Robbery; Domestic Violence; Suicide; Murder; Vehicle

- HIV personal protection programme

Accidents; Natural Disasters or requires Bereavement counselling;

- The Care Centre will provide advice and access to;

- Telephonic counselling

Face-to-Face counselling

The Family Funeral Plan provides cover in the event of the death of the insured member. The policy pays out a cash sum.

Who will benefit from the Family Funeral Plan?

An individual over 18 who wishes to ensure that his / her family has one less difficulty to deal with should the customer insured life pass away. This would also be whereby the customer’s parents and close family can be insured to lessen the difficulty of dealing with any of them passing away.

Product Features:

- NO medicals.

- Individual cover of up to R 30,000.00

- Entry age from 18 up to 65.

- Cover:

- Main member cover option: R 10 000, R 15 000, R 20,000 and R 30 000

- Spouse will enjoy cover of the same amount as chosen for yourself.

- Included in the family plan premium, you can nominate up to 8 dependent children, 5 included and the additional 3 at R1.5 per child (Cover adjusted depending on age).

- Parents/In-Law (4) cover option: R 5 000 and R 10 000

- Extended Family Members (4) cover option: R 5 000 and R 10 000

- Funeral benefit paid out within 48 hours of receiving all documentation.

Value-add benefits

- REPATRIATION OF MORTAL REMAINS

In the event that the body of the deceased is required to be transported to the home town, the following benefits have been included:

- Location of deceased

- Overnight accommodation (1xperson) to identify the body (R5000)

- Repatriation to funeral home closest to place of burial in RSA only

- 1x Family member can accompany the body

- Assistance with all paperwork / funeral arrangements

- Advice on how to apply for the death certificate

- Referral to a reputable funeral

- Referral to a Pathologist if an autopsy is required

- “PERSONAL PROTECTION PLAN”:

- HIV personal protection programme

- Members will have access to the following, should they fear accidental exposure to HIV/AIDS and must contact the Care Call Centre within 24 hours of the exposure:

- Unlimited 24 hour access to the Care Call

- Telephonic counselling

- Access to an HIV medical

- An initial Starter Pack of 3 days ART’s;

- ART treatment for a further 28 ▪ Clinical disease management guidance ▪ Trauma assistance programme:

- The morning after pill;

- Sexually transmitted disease preventative medication;

- Unlimited Face-to-Face counselling

- Security benefits up to a maximum of R1500.00

- Alternative Therapies up to a maximum of R1500.00

- Members will also have unlimited access to the Care Call Centre

- Trauma Assistance

- In the event that the member is exposed to: Rape; Hijacking; Assault; Mugging; Armed Robbery; Domestic Violence; Suicide; Murder; Vehicle

- HIV personal protection programme

Accidents; Natural Disasters or requires Bereavement counselling;

- The Care Centre will provide advice and access to;

- Telephonic counselling

Face-to-Face counselling